20 Handy Facts For Choosing Trading Chart Ai Stocks

20 Handy Facts For Choosing Trading Chart Ai Stocks

Blog Article

Top 10 Tips To Regularly Monitoring And Automating Trading Stock Trading, From Penny To copyright

In order for AI stock trading to be successful, it is crucial to automatize trading and ensure regular monitoring. This is particularly true in markets that move quickly such as penny stocks or copyright. Here are 10 top suggestions to automate and monitor trading to ensure that it is performing.

1. Start by setting Clear Trading Goals

TIP Make sure you know your goals for trading. These include risk tolerance levels returns, expectations for return, preference for assets (penny stock or copyright, both) and much more.

Why: Clear goals will guide the selection of AI algorithms, risk management rules and trading strategy.

2. Trade AI with Reliable Platforms

Tips: Choose an AI-powered trading platforms that allow the full automation of trading and integrates to your broker or currency exchange. Examples include:

For Penny Stocks: MetaTrader, QuantConnect, Alpaca.

For copyright: 3Commas, Cryptohopper, TradeSanta.

What's the reason: A strong platform that has strong execution capabilities is essential to automated success.

3. Customizable trading algorithms are the key area of focus

TIP: Make use of platforms that allow you to develop or modify trading algorithms that are tailored to your specific strategy (e.g. trend-following, trend-following, mean reversion, etc.).).

What's the reason? The strategy is tailored to your style of trading.

4. Automate Risk Management

Create risk management tools that are automated including stop loss orders, trailing stops, and take profit levels.

Why: These safeguards protect your portfolio against large loss, especially when markets are volatile, such as copyright and penny stock.

5. Backtest Strategies Before Automation

Test your automated methods back in order to evaluate their performance.

Why? Because by backtesting you can be sure that your strategy is able to work well in real-time markets.

6. Be sure to monitor performance on a regular basis and adjust settings as needed

Tips: Even though trading could be automated, monitor every day to identify any issues.

What to Monitor: Profits and losses and slippage as well as whether or not the algorithm is aligned to current market conditions.

Why? Monitoring the market constantly permits timely adjustments as conditions change.

7. The ability to adapt Algorithms to Implement

Tip: Use AI tools to modify trading parameters in real-time based on the data.

The reason: Markets are constantly changing and adaptive algorithms can align strategies for penny stocks and copyright with the latest trends, volatility or other factors.

8. Avoid Over-Optimization (Overfitting)

Tips: Beware of over-optimizing automated systems with previous data. It could lead to an over-fitting of your system (the system might work well in backtests, but not so well under real-world circumstances).

Why? Overfitting decreases the generalization of the strategy to the market's future conditions.

9. AI can be employed to spot market anomalies

Use AI to identify abnormal market patterns and anomalies (e.g., sudden spikes of news volume, sudden spikes in trading volume, or copyright whale activities).

What's the reason? By identifying these signals early, you are able to adjust your automated strategies in advance of any significant market change.

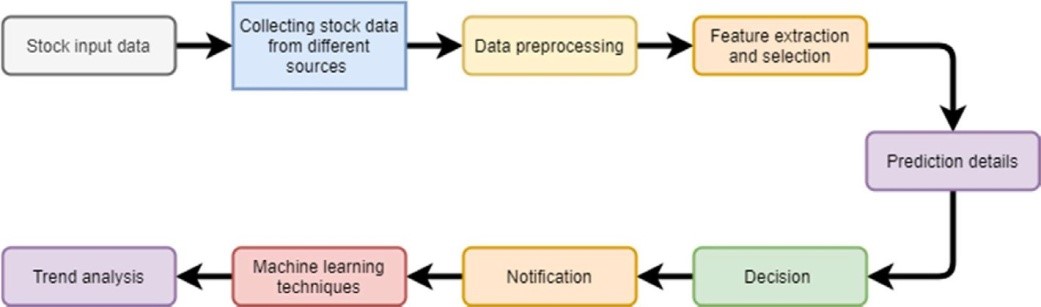

10. Integrate AI into regular notifications and alerts

Tips : Set up real time alerts for major market trading events that are significant or significant, and also for changes in the performance of algorithms.

Why are they important? Alerts allow you to know about important market movements. They also allow you to act fast, particularly when markets are volatile (like copyright).

Bonus Cloud-based Solutions can be scaled

Tips - Make use of cloud trading platforms to maximize scalability. They're more efficient and allow you to run multiple strategies at the same time.

Cloud solutions are vital to your trading system, because they permit it to operate 24/7 without interruption, and especially in copyright markets that are never closed.

By automating and monitoring your trading strategies, you can improve efficiency and reduce risk by making use of AI to power copyright and stock trading. Check out the best best ai copyright prediction for more info including ai for stock market, ai stock picker, ai trade, best stocks to buy now, ai stock picker, ai stocks, ai stocks to buy, incite, trading chart ai, trading ai and more.

Top 10 Tips To Concentrating On Portfolio Diversification Ai Stock Pickers, Predictions And Investments

It is essential to focus on a diverse portfolio when trying to maximize return and minimizing risk particularly if you're employing AI to invest and stock forecasting, or picking stocks. AI assists in identifying and managing diversification opportunities across asset classes and sectors. Here are ten top tips on how you can focus on diversifying your portfolio using AI-driven strategy:

1. AI Asset Allocation Optimization: Make the Most of AI

Tip: By using AI models, you can determine the most optimal allocation between bonds, stocks, commodities and other investment options, by analyzing historical data and the market's conditions, preferences for risk and historical data.

The reason: AI lets you dynamically allocate capital across different various asset classes. Your portfolio will be well-diversified. Market volatility will have less impact on your returns.

2. Diversify your business's operations across different industries and sectors

Spread risk by making use of AI to identify new opportunities in different markets and sectors.

Why is that sector and industry diversity allows you to safeguard your portfolio from the effects of downturns while also benefiting from growth. AI is able to track patterns of performance and anticipate trends in sector rotation which can help make better investment decisions.

3. AI can assist you in identifying assets with no relation to one another.

Tip: Make use of AI technology to identify and select assets with low correlations. This can reduce risk in your overall portfolio.

Why? By selecting investments with low or even negative correlations AI will help to make sure that there is a balance between the risk and the return of the portfolio, since different assets are less responsive to the same events in the market simultaneously.

4. Incorporate International and Emerging Assets

Tips: To improve geographical diversification, make use of AI to mix the stocks of emerging markets and international markets.

What is the reason? Different regions respond differently to economic trends. International stocks, particularly ones from emerging markets, offer exposure to global economic growth and reduces the risks associated with local economic or geopolitical issues.

5. AI can be used to monitor and improve your portfolio.

TIP: Use AI-powered tools for regular portfolio monitoring and for adjusting your asset allocation according to changes in the market or risk profiles, as well as financial goals.

Why? Because markets are dynamic and AI monitoring is constantly ensuring that your portfolio is diversified according to the current data. This helps you adapt to changes in economic and market sentiment.

6. AI: Factor investing with AI

Use AI to implement various factors-based strategies to diversify the risk of your portfolio.

What is the reason: AI analyzes large datasets to determine the performance of factors and forecast it. This allows you to create an array of portfolios that are balanced the different types of investments, factors, and can improve the returns.

7. Use AI to Diversify Risks

Tip: Use AI technology to identify the risks that come with each investment you own and then spread them across by investing in both high-risk and low-risk assets.

The reason: AI has the ability to assist in identifying investments that have lower volatility as well as ones with higher returns but greater risk. The ability to balance these risk profiles across your portfolio is essential for maximising returns and protecting yourself from losses.

8. Include other assets in your portfolio

Tip: Utilize AI to discover non-traditional investment options including private equity, cryptocurrencies, real estate and commodities. This can help you diversify your portfolio.

The reason: Alternative assets may differ from traditional stocks and bonds and bonds, thereby providing an additional source of diversification. AI can be used to identify and predict market trends, so you can make informed choices about the incorporation of these assets into your portfolio.

9. AI-based simulation of scenarios and stress tests

TIP: Make use of AI-driven simulations and stress tests to determine how your portfolio would perform in extreme market conditions or in hypothetical scenarios (e.g., market crashes, economic recessions).

Why is this: Stress testing with AI helps you identify possible weaknesses in your diversification strategy, ensuring that your portfolio remains resilient during market downturns or sudden situations.

10. Balance Long-Term and Short-Term Investments

Tip Use AI to achieve the right balance between short-term gains and stability over the long term.

Why: A portfolio that is diverse should have both stable, long-term investments, as well as high-growth immediate opportunities. AI can identify patterns and forecast trends to determine which assets or stocks will likely to outperform in the short term, while ensuring long term portfolio growth.

Bonus: Continue to rebalance your bonus according to AI insights

Tip: You can use AI to regularly rebalance your portfolio to ensure that it is in sync with your changing risk tolerance and the market conditions.

Why: Market fluctuations can affect your portfolio's asset allocation to fluctuate over time. AI assists in rebalancing or re-aligning your portfolio in a timely and efficient manner.

AI helps to create and maintain a diverse portfolio through the implementation of these strategies. It will balance the risk and rewards while adapting to the changing market. AI is able to analyze massive amounts of data to simulate different market situations and allows the making of data-driven, well-informed choices. Have a look at the top rated ai penny stocks for blog advice including ai penny stocks, ai stock picker, trading ai, ai stock trading, best ai stocks, ai for stock trading, ai copyright prediction, ai for stock market, ai stock trading bot free, ai trading software and more.